How to Read Tax Statements

Green Statements

A Green statement indicates that the property owner is responsible for paying the bill.

Yellow Statements

A Yellow statement indicates one of two things:

- Our records indicate a mortgage company has requested your property tax bill, they will be paying your taxes.

- OR; You are receiving a Senior or Disabled Tax Deferral in which the Oregon Department of Revenue will pay all or part of the property tax

Taxpayers are urged to check with their mortgage company if they believe their current arrangement is not reflected by the color of the tax statement. This has been an area of confusion in the past years, resulting in double payments or late payments in some cases.

Important Date Information

- Late payments lose the discount, and the tax begins accruing interest after the due date.

- In Oregon, property is valued each year as of January 1.

- The property tax year runs from July 1 through June 30.

- Property taxes are due November 15 each year, unless it falls on a weekend or holiday. The dates at the top of your statement reflect the property tax year for the property taxes imposed.

- Trimester payment due dates are November 15, February 15, and May 15, unless it falls on a weekend or holiday.

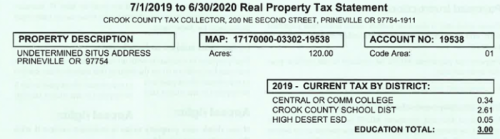

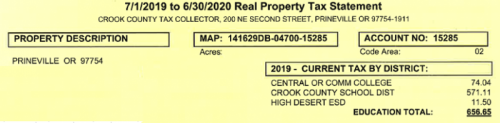

Property Description

Identifies certain characteristics of your property (when applicable) by:

- Code: Tax levy code that defines the list of taxing districts for your property.

- Map: Represents the location of your property by township, range, section and tax lot as per the Assessors' Maps.

- Legal: Some properties may be identified by their legal description if it is a lot and block in a subdivision.

- Situs (if any): The address assigned by Community Development

- Account No: Tax ID in the Assessors' records.

Current Tax Year Detail

Your tax statement shows the taxes collected for each of the districts in which your property is located. These taxes are shown on your statement as a Levy, Local Option Levy (LOL), Bond, or a Special Assessment.

- Educational: Assessed for Central Oregon Community College, your property's Educational Service District and K-12 school district.

- General Government: Paid to cities, regional government, county and special districts (water, sewer, fire, etc).

- Bond: Finance capital improvements such as school buildings, parks, or public works projects that have been authorized by voters.

Values

- Real Market Value (RMV): is based on what your property would have sold for in a transaction between a willing buyer and a seller on January 1. Each year appraisers analyze actual sales information from each neighborhood in order to make adjustments needed to bring property values in line with the market activity. Typically RMV is not the basis for your taxable value.

- Maximum Assessed Value (MAV): is the taxable value limit maintained for each property under the provisions of Ballot Measure 50. In 1997 (the first year of Measure 50) the MAV was established for each property based on its 1995-96 tax roll value minus 10%. Unless certain changes are made to your property, your MAV may increase by no more than 3% each year.

- Assessed Value (AV): is the value your taxes are based on. It is the lesser of the Real Market Value (RMV) or the Maximum Assessed Value (MAV) on your property.

- Exception Value: is additional value that may be added to the MAV for specific reasons. If you made a change to your property such as new construction, rezoning, partition, or subdivision, your new assessed value may increase by more than 3%. Minor construction projects and on-going maintenance and repairs, are not exceptions and are not added to a property's Maximum Assessed Value.

- Delinquent Taxes: Any prior year's tax remaining unpaid will be listed just below your current year total tax due on the front, right hand side of the statement. Delinquent amounts that will be subject to foreclosure, if not paid by May 15 the following year, will be indicated with an asterisk (*). Payments will be applied to the oldest tax year first.

Informational Flyer

An informational flyer is included with each tax statement to be used as a guide for a better understanding of the property tax statement, payment options, and other programs associated with the Oregon Property Tax System.